BreakPoint

Should the government encourage or discourage charitable giving? It’s not a trick question.

BreakPoint: Charitable Giving

Should the government encourage or discourage charitable giving? It’s not a trick question.

With a federal deficit of nearly $1.6 trillion a year and a national debt of about $15 trillion, the government is scrounging for every dollar it can find. So, no surprise, President Obama’s jobs plan seeks to eliminate so-called “tax loopholes.” And it should.

I’ve said many times that we’ve got to end corporate welfare and loopholes (like the ethanol deduction). These cost the Treasury billions and they help only the privileged interests who can hire lobbyists.

But tucked inside the President’s jobs plan, which failed to pass Congress, but the President will be re-submitting it bit by bit, is a provision capping charitable deductions for wealthy tax payers.

That’s a loophole? Now, we Christians believe that everyone needs to pay their fair share of taxes, and, in these hard economic times, all of us need to bite the bullet and make sacrifices. Are we therefore being hypocritical to fight limiting charitable deductions? I don’t believe we are.

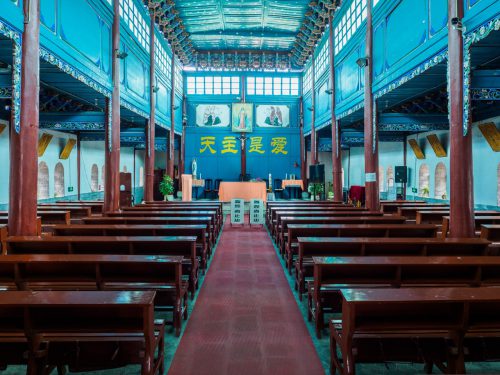

For one thing, allowing charitable deductions to religious organizations in particular recognizes the separation of church and state and freedom of religion. But secondly, limiting the charitable deduction, even for so-called “millionaires and billionaires,” makes no economic sense.

Charities, especially religious charities, provide services that the government won’t or can’t do efficiently. The Internal Revenue Service says that individuals claimed nearly $34.9 billion in charitable deductions on their federal tax returns in 2009. But what does the government get in return? Look just at what Catholic Charities does for AIDS victims, or for the savings religious schools provide municipalities. Or the services provided by homeless shelters, prison ministries (like Prison Fellowship), medical research, and on and on.

Proponents say that reducing the tax deductibility of charitable giving among the wealthy won’t really hurt nonprofits. But the top 2 percent of earners gave a third of all charitable contributions in 2008. And while no one can predict with certainty what might happen, an organization called the Independent Sector says the limiting deductions might cost $7 billion in donations every year.

Having said all that, there may be legitimate ways of rooting out abuses, which can occur sometimes with private foundations, and limiting deduction to charities that claim no religious purpose and provide no public benefit. But this one-size fits all approach that we’re trying now won’t work.

Now, don’t expect the idea of limiting charitable tax deductions to go away. The Administration first attempted to do this back in 2009, and again in its 2012 budget.

But as Christianity Today has written, “Governments should expand incentives for Americans to give ever more generously to charitable groups.” CT adds, “[W]hen charities deliver services, they get more bang for the buck than government programs . . . Nonprofits are not only more efficient in themselves, but charitable donations leverage no small amount of volunteer time.” I can attest to that, because that’s the case with thousands of Prison Fellowship volunteers.

Folks, given our struggling economy, this would be an especially bad time to deprive nonprofits of the resources needed to help our communities. Keep your eyes peeled: Whenever the idea pops up again—and believe me, it will — don’t be afraid to tell your congress person that in times like these, we need more charitable giving, not less.

Save

With a federal deficit of nearly $1.6 trillion a year and a national debt of about $15 trillion, the government is scrounging for every dollar it can find. So, no surprise, President Obama’s jobs plan seeks to eliminate so-called “tax loopholes.” And it should.

I’ve said many times that we’ve got to end corporate welfare and loopholes (like the ethanol deduction). These cost the Treasury billions and they help only the privileged interests who can hire lobbyists.

But tucked inside the President’s jobs plan, which failed to pass Congress, but the President will be re-submitting it bit by bit, is a provision capping charitable deductions for wealthy tax payers.

That’s a loophole? Now, we Christians believe that everyone needs to pay their fair share of taxes, and, in these hard economic times, all of us need to bite the bullet and make sacrifices. Are we therefore being hypocritical to fight limiting charitable deductions? I don’t believe we are.

For one thing, allowing charitable deductions to religious organizations in particular recognizes the separation of church and state and freedom of religion. But secondly, limiting the charitable deduction, even for so-called “millionaires and billionaires,” makes no economic sense.

Charities, especially religious charities, provide services that the government won’t or can’t do efficiently. The Internal Revenue Service says that individuals claimed nearly $34.9 billion in charitable deductions on their federal tax returns in 2009. But what does the government get in return? Look just at what Catholic Charities does for AIDS victims, or for the savings religious schools provide municipalities. Or the services provided by homeless shelters, prison ministries (like Prison Fellowship), medical research, and on and on.

Proponents say that reducing the tax deductibility of charitable giving among the wealthy won’t really hurt nonprofits. But the top 2 percent of earners gave a third of all charitable contributions in 2008. And while no one can predict with certainty what might happen, an organization called the Independent Sector says the limiting deductions might cost $7 billion in donations every year.

Having said all that, there may be legitimate ways of rooting out abuses, which can occur sometimes with private foundations, and limiting deduction to charities that claim no religious purpose and provide no public benefit. But this one-size fits all approach that we’re trying now won’t work.

Now, don’t expect the idea of limiting charitable tax deductions to go away. The Administration first attempted to do this back in 2009, and again in its 2012 budget.

But as Christianity Today has written, “Governments should expand incentives for Americans to give ever more generously to charitable groups.” CT adds, “[W]hen charities deliver services, they get more bang for the buck than government programs . . . Nonprofits are not only more efficient in themselves, but charitable donations leverage no small amount of volunteer time.” I can attest to that, because that’s the case with thousands of Prison Fellowship volunteers.

Folks, given our struggling economy, this would be an especially bad time to deprive nonprofits of the resources needed to help our communities. Keep your eyes peeled: Whenever the idea pops up again—and believe me, it will — don’t be afraid to tell your congress person that in times like these, we need more charitable giving, not less.

Save

10/20/11